A Note for Employees

If you are an employee concerned about your pay, redundancy, or company closing down, your rights are different. Please see our dedicated guide: What are my rights if my company becomes insolvent?

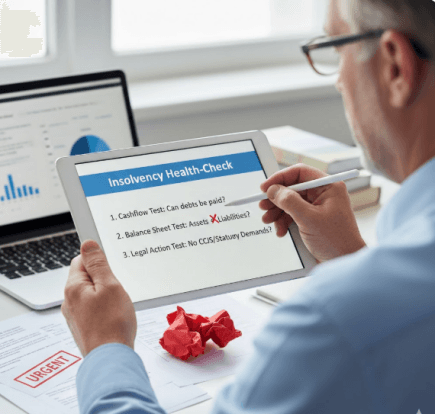

A company is deemed to be insolvent if it is unable to pay its debts as and when they are due, or the value of its liabilities is larger than the total value of its assets. However, having a negative balance sheet does not necessarily mean that the company will go into an insolvency process. To establish if your company is insolvent, you need to apply the three tests for insolvency that will determine if your company is viable in the future.

Director’s Duties

If your company fails any of the insolvency tests, it is vital that you and the board of directors take immediate action.

Remember this warning: Once a company is insolvent, your duty shifts. You must now act to MAXIMISE CREDITORS’ INTERESTS.

Failure to do so risks accusations of wrongful trading, which can lead to personal liability for the company’s debts. This is because a liquidator may apply to have the veil of incorporation removed, compelling you as a director to personally repay the company’s creditors.

Top 10 Warning Signs Your Company is Insolvent

If your business exhibits several of these signs, you must seek professional advice immediately, as your company may be insolvent

- HMRC Arrears: Consistent lateness or inability to pay PAYE or VAT liabilities on time, or having an existing Time To Pay (TTP) arrangement fail.

- Cashflow Crisis: Constantly running at or exceeding the overdraft limit with the bank, or struggling to meet payroll and supplier payments as they fall due.

- Creditor Pressure: Receiving Statutory Demands, County Court Judgements (CCJs), or threats of a Winding Up Petition.

- Supplier Issues: Suppliers demanding Cash on Delivery (COD), credit being refused, or credit terms being reduced or revoked.

- Factoring Problems: Your factoring company reducing advance rates, disallowing invoices, or expressing concerns about the quality of your debtors.

- Banking Restrictions: The bank refusing new lending, demanding personal guarantees, or increasing demands for detailed financial information.

- Late Filings: Accounts and returns are filed late at Companies House, resulting in penalties and loss of credibility.

- Customer Reliance: Heavy reliance on one or two major customers, creating instability if a contract is lost or delayed.

- Funding the Business Personally: Directors are required to use personal funds or constantly refinance assets just to keep the business operational.

- Management Avoidance: The management team or directors are avoiding professional advice, ignoring financial reports, or dreading opening mail/answering calls.

The Three Important Tests for Insolvency

The Cashflow Test

This is the most important insolvency test. Put simply – can the company pay its debts when they fall due? For example, if your company is not paying the deductions from employees for NIC and PAYE across to HMRC on the 19th of the month following the month they were deducted, then the company could be insolvent. If the company has a Time to Pay arrangement with HMRC or any other creditor, it IS definitely insolvent. Many directors tell us that “my company cannot be insolvent because HMRC allowed us to agree a long term repayment plan or TTP”. Actually the opposite is true; HMRC knows that YOUR company is insolvent, but it allows a period of time to repay the debt. If trade creditors sell to the company on, say, 30-day terms and the company regularly pays on 90+ days, then this could also mean the company is insolvent. A director has a legal requirement to understand this issue. If you believe that the company has insufficient cash to pay its liabilities on time, you must take action.

The Balance Sheet Test

If the company has a negative balance sheet, this means it has more liabilities (debts) than it has assets. The company may still be paying creditors on time and therefore passing the cashflow test, but it can still have a negative or insolvent balance sheet. If your company has a negative balance sheet AND it fails the cashflow test, you should take expert advice from insolvency practitioners quickly. Your own accountant is unlikely to have much experience of these issues, but any reputable insolvency practice will give you free initial advice on whether your company is insolvent.

The Legal Action Test

Threats of legal action do not necessarily mean the company is insolvent. However, if an action is filed in court against your company, then the company does fail this test. These legal actions point to the company’s inability to meet its liabilities. County Court Judgements, Statutory Demands, and Winding Up Petitions are all very serious for your company. You must take advice from insolvency advisors if you have any of these actions against your company, or if a creditor is threatening to take them.

So what are the main options?

Rescue Options

If your company is insolvent but you believe it is still a viable business, these formal insolvency procedures can allow you to continue trading while being protected from creditor pressure. The goal is to restructure the company and its debts to secure its future.

Propose a Company Voluntary Arrangement (CVA)

A CVA is a payment plan that allows you to restructure your company’s unsecured debts. The company’s directors propose affordable monthly payments to creditors over a fixed period. If approved creditors cannot take further legal action. The process lasts for up to five years, and on successful completion, any remaining unsecured debt is written off. This provides a clear path to recovery while you remain in control of the business.

Restructure via Administration

Entering administration puts your company in a temporary state of protection, or a moratorium, which halts all creditor action and legal proceedings. We will act as administrator, with the primary purpose of rescuing the company. We will work to restructure it into a leaner, more profitable organization. If a rescue is not viable, we will help you find the most appropriate exit, such as a sale of the business or a transition to another insolvency procedure.

Closure Options

If your company fails the solvency tests and is not viable, these procedures will allow you to formally close the company down, draw a line under its operations, and write off its unsecured debts. This is a final and irreversible process that protects you from creditor pressure.

Propose a Creditors Voluntary Liquidation (CVL)

A CVL is a liquidation procedure for insolvent companies. 75% of shareholders need to approve a CVL to formally wind the company up. We will then liquidate any assets, use the funds to pay creditors, and get the company dissolved. If your company has employees, they can claim for redundancy and other statutory entitlements through the government’s Redundancy Payment Service (RPS). The process is final, and once completed, you can move on.

Get in touch with us

If you’re concerned that your company might be insolvent you must contact us immediately. We will advise on the most appropriate solutions and help you take the best direction for your company. Our process is:

- Speak with our initial advisers: Make contact with our team, via phone, form, or online chat. We will arrange a free consultation with one of our consultants to discuss your situation in depth.

- Initial assessment: We will advise if an insolvency procedure is the most appropriate route forward or if alternative solutions better suit your company’s problems.

- Formally engage with our team: If there is an appropriate insolvency solution, we will confirm the necessary steps to start the procedure and issue you with the relevant documentation for you to formally engage us.

Don’t delay. Call us on 0800 9700539 to speak with one of our advisers.